ABOUT FREE TAX PREP

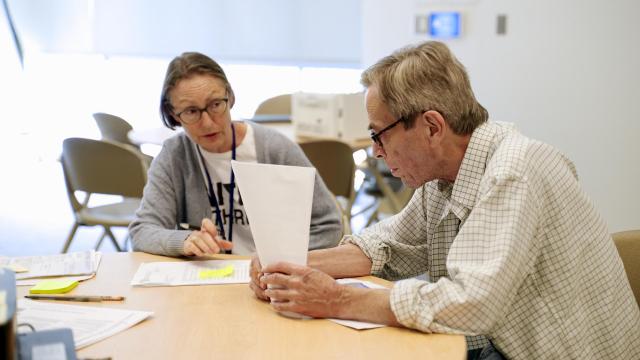

United Way of Greater Cincinnati believes all individuals deserve economic well-being. Our Free Tax Prep initiative provides free income tax preparation and filing services.

Funded by the Department of Treasury and Internal Revenue Service (IRS), Free Tax Prep is powered by our network of hundreds of committed volunteers dedicated to helping families and individuals have stronger financial futures and experience less stress during filing.

Many hardworking people in our region qualify for tax credits, including the Earned Income Tax Credit (EITC) and Child Tax Credit, but are not getting the full refund they deserve. United Way can help.

In addition, Free Tax Prep also helps families save an average of approximately $300 in tax preparation fees.

NEED TAX HELP?

Need assistance with tax filing?

We offer a range of services for preparing and filing your taxes on your behalf; or supporting you in preparing and filing your taxes on your own.

To determine the best Free Tax Prep service for you, click "GET HELP" below or dial 211 to speak to one of our helpline care coordinators.

GIVE TAX HELP

Want to make an impact in our community?

Take the first step in helping families move toward the economic well-being they deserve by becoming a Free Tax Prep volunteer.

There are roles for a variety of interests and skill sets and United Way will also provide training.

FOR MORE INFORMATION:

For more information about Free Tax Prep or if you have any questions, email us at [email protected] or call us at 211 or 513-721-7900.

RELATED STORIES

Volunteers Are Needed to Meet The Demand For Free Tax Prep Initiative

United Way's Free Tax Prep service seeks volunteers