HOW DOES FREE TAX PREP HELP FILE MY TAXES?

American families on average spend more than $275 a year on tax preparation and filing fees. Why pay for tax preparation when United Way offers services to do your taxes for free?

With United Way’s Free Tax Prep, what you save in fees could mean the difference between paying down a credit card, starting (or adding to) an emergency fund, catching up on medical bills or getting a car repaired.

Tax Season starts in January 2025. We will begin accepting appointments on January 20, 2025. Please come back and visit us at that time!

Before you spend several hundred dollars on a fee-based service, connect with one of United Way’s Free Tax Prep sites to access the service that meets your needs.

- MyFreeTaxes.com is a free self-filing tool available through United Way Worldwide.

- Complete your return on your own at your own pace. MyFreeTaxes uses TaxSlayer software, a tax service with over 50 years of experience in the industry. The software guides you through the return and there's additional help available to answer common questions.

- Self-prep at Free Tax Prep sites ("FSA" option) is a self-filing tool but with support and assistance available on site.

- Prepare and file your own basic state and federal tax forms using TaxSlayer web-based tax software with help from a tax coach who is an IRS-certified volunteer.

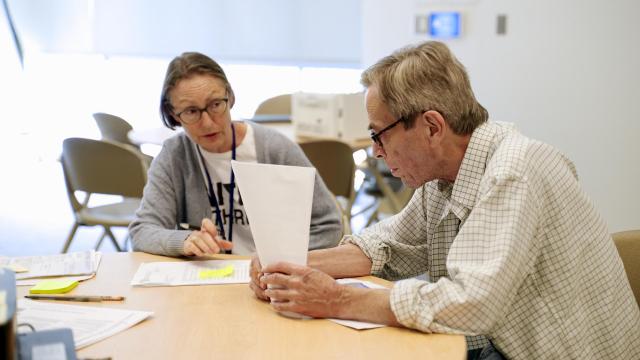

- Traditional Volunteer Income Tax Assistance (VITA) sites provide multiple options.

- Free tax return preparation offers either in-person or drop-off services.

- Sites are operated by experienced IRS-certified volunteers to help taxpayers complete basic state and federal tax returns.

The following are all eligible for our free tax preparation and filing services. If you have questions about your eligibility, please call us at 211 or 513-721-7900, option 0 for “All other services.”

- Low-to-moderate-income taxpayers.

- Individuals & families on fixed incomes.

- College students.

- People with disabilities.

- Those with limited English language abilities.

Each tax year you may be required to bring new forms or information. Keep current on what you need each tax season by reviewing IRS.gov’s Publication 3676-A checklist.

You can also save time by completing IRS Intake Form 13614-C ahead of time and bringing it with you to your appointment.

| IRS TAXES CHECKLIST: Publication 3676-A (.PDF) | IRS INTAKE FORM: Publication 13614-C (.PDF) |

Summer Tax Season

Summer tax season begins in May. You can schedule an appointment now at Boone County Public Library.

Visit our new interactive map for an up-to-date listing of all tax sites this season. Links in the site description to schedule an appointment.

Search by ZIP code to find the most convenient location for you. Filter locations by service model, appointment types and more. This map can also help you get driving directions and bus route information!

FREQUENTLY ASKED QUESTIONS

Where is my tax refund?

- I haven't received my refund yet. What should I do?

To understand how federal returns are processed, visit the NTA Blog: Lifecycle of a Tax Return - Taxpayer Advocate Service on IRS.gov.Taxpayers can continue to check the status of their refund by utilizing the IRS’s "Where's My Refund?" tool.

For those seeking information about their state return, you can visit the following state agencies:

- Ohio Department of Taxation - https://tax.ohio.gov/individual

- Kentucky Department of Revenue - https://revenue.ky.gov/

- Indiana Department of Revenue - https://www.in.gov/dor/

What if I cannot find a site or file by April 15, 2024?

- What if I cannot find a site or file by April 15, 2024?

- Any taxpayer may still file after the April 15 deadline. Those who do not owe will not incur a penalty.

- Taxpayers who are unsure if they will owe can file a federal extension by obtaining IRS Form 4868 at: https://www.irs.gov/pub/irs-pdf/f4868.pdf.

Your extension to file is not an extension to pay a potential tax bill. Learn more at https://www.irs.gov/forms-pubs/extension-of-time-to-file-your-tax-return. - Those who do not file by April 15, 2024, but have filed for an extension, will have until October 15, 2024, to e-file their federal return.

Do I qualify for Free Tax Prep?

- Do I qualify for Free Tax Prep?

You can usually get help if you identify as low-to-moderate-income and live in the Greater Cincinnati area.

For a list of forms that are not within our preparation scope, visit IRS.gov’s Publication 3676-A . This will also help you determine what forms can be prepared and the essential documents to ensure your taxes are prepared on your first visit.

What do I need to file my taxes?

- What do I Need to File my Taxes?

For a full list of documents required to file taxes visit the Checklist for Free Tax Return Preparation | Internal Revenue Service (IRS.gov).

How to I find a Free Tax Prep site near me?

- How do I find a Free Tax Prep service near me?

Call 211 or 513-721-7900, option 0 for "All other services," to find the best option for you.

HAVE ADDITIONAL QUESTIONS?

For more information about Free Tax Prep or if you have any questions, email us at [email protected] or call us at 211 or 513-721-7900, option 0 for "All other services."

WANT TO HELP OR BECOME A PARTNER?

To become a Free Tax Prep partner organization or volunteer, visit uwgc.org/tax-volunteer.

RELATED STORIES

Volunteers Are Needed to Meet The Demand For Free Tax Prep Initiative

United Way's Free Tax Prep service seeks volunteers