Tax Prep Volunteering Is a Great Way To Give Back

(United Way of Greater Cincinnati)

CINCINNATI (Jan. 3, 2024) — A few years ago, when Jeff Kuntz was newly retired and considering how to spend his free time, United Way of Greater Cincinnati’s Free Tax Prep service checked two important boxes: “I enjoy working with numbers. And I enjoy helping people,” the Alexandria resident says.

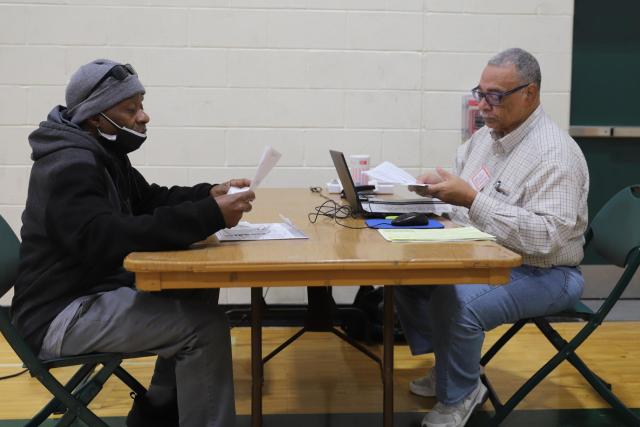

He now does both as one of the trained, IRS-certified volunteers who provide free tax preparation and filing services for low-to-moderate-income taxpayers—saving each client approximately $300 in tax preparation fees. During tax season, Kuntz volunteers at Free Tax Prep sites in Northern Kentucky. There are about 40 sites throughout the Greater Cincinnati region.

Kuntz has an accounting degree and a financial background, but neither is necessary to become a Free Tax Prep volunteer. Volunteers just need to be personable and friendly, comfortable working with diverse clients, willing to ask questions, able to use a computer, open to learning new skills, and willing to adhere to high ethical standards. UWGC provides training and ongoing support.

Before becoming a Free Tax Prep volunteer, Kuntz had prepared tax returns only for himself and his family. Helping others, however, brings its own rewards.

(John Johnston / United Way of Greater Cincinnati)

He recalls reviewing the tax return of a couple who have a child with a disability. It was important they get the full refund they deserved. In fact, they were due a refund, but Kuntz noticed that federal taxes had been withheld from their Social Security payments. That figure had not been entered on their return.

“So, I entered it, and they got a [refund of a] couple thousand dollars more. Maybe it would have been caught by the IRS, but it just felt good that I was able to catch that,” Kuntz says.

(John Johnston / United Way of Greater Cincinnati)

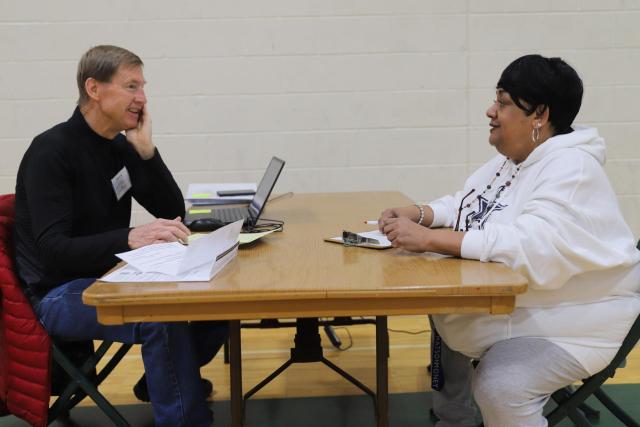

Schone Walker, who has relied on Free Tax Prep for several years, takes comfort in knowing the volunteers are knowledgeable about the latest tax laws so she doesn’t have to be. “It takes the worry off your shoulders,” she says. “I trust the volunteers 100 percent.”

Walker’s taxes were prepared by Doug Becker, a retired airline pilot from Anderson Township who has been a Free Tax Prep volunteer for nearly a decade. “There are a zillion [volunteer] opportunities,” Becker says, “but sometimes you feel like you’re not really contributing. Free Tax Prep is direct, one-on-one. I know I’m helping this person.”

For the 2022 tax year, United Way volunteers assisted with 7,600 returns; refunds and savings totaled nearly $11 million.

If you’re interested in helping for the 2023 tax season, there is still time to sign up. To learn more about volunteering for UWGC’s Free Tax Prep program, click here.

United Way of Greater Cincinnati is a registered 501(c)(3) non-profit organization [Tax ID: 31-0537502]. Contributions are tax-deductible to the extent permitted by law.